The Pitfalls of Vacation Debt: Opting for Smart Planning Instead"

- Carol Garcia

- Mar 12, 2024

- 3 min read

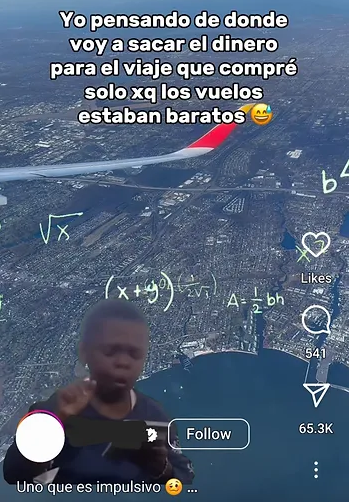

In the age of social media, memes have become a popular way to share humor and relatable content. However, the humor turns dangerous when memes joke about getting into debt to fund vacations. Let's explore why these memes aren't just unfunny but carry significant risks.

Memes that make light of going into debt for a vacation can inadvertently normalize financial irresponsibility. By presenting debt as a casual or humorous choice, these memes downplay the severe consequences of such actions.

Trivializing the financial strain of borrowing for non-essential expense

s overlooks the harsh realities individuals face when dealing with debt, including stress, anxiety, and potential long-term damage to their financial health.

Social media has a powerful influence on behavior, especially among younger audiences. Memes joking about vacation debt may inadvertently encourage individuals to make poor financial decisions, thinking it's a socially acceptable or humorous choice.

But behind every meme is a real person with real struggles. Making light of financial challenges through memes can mask

people's genuine difficulties when managing their money. It's essential to approach financial discussions with sensitivity and awareness of the diverse economic situations that individuals may be navigating.

Memes that make light of accumulating debt for vacations can contribute to a culture that minimizes the impact of financial struggles on mental well-being, potentially exacerbating stress and anxiety for those already facing economic challenges.

In today's fast-paced world, the allure of a relaxing vacation can be irresistible—it is even encouraged by mental health specialists. However, succumbing to the temptation of going into debt for a getaway might not be the wisest financial decision. It can contribute to financial stress, which in turn can contribute to mental health issues.

Let's explore why avoiding vacation debt is crucial and how opting for a strategic savings plan or utilizing travel agents offering installment payments can be a wiser choice.

Interest Accumulation: Taking out loans or relying on credit cards to fund your vacation can lead to hefty interest payments, turning a relaxing trip into a long-term financial burden.

Stress and Guilt: Returning from a vacation to face looming debt can overshadow the joy of the experience. The stress and guilt associated with financial strain can negate the positive effects of the getaway.

Limited Financial Freedom: Accumulating debt for non-essential expenses restricts your financial flexibility, making it harder to tackle unexpected emergencies or achieve long-term financial goals.

The Power of Strategic Savings:

Financial Security: Saving for a vacation in advance ensures you enjoy your getaway without worrying about debt. It also provides a safety net for unforeseen circumstances.

Discipline and Budgeting: Planning and saving for a vacation requires discipline and budgeting skills. This financial responsibility can positively impact your overall financial habits.

Peace of Mind: Knowing that your vacation was funded with your hard-earned money brings peace of mind. You can truly relax and savor the experience without the looming shadow of debt.

Exploring Alternatives: Travel Agents with Installment Plans:

Flexible Payment Options: Many travel agents now offer clients the option to pay for their trips in installments, which allows you to spread the cost over time, making the financial burden more manageable.

Avoiding Interest: Unlike loans or credit card debt, installment plans with travel agents typically don't incur Interest. This option makes it a cost-effective and convenient way to finance your dream vacation.

Professional Guidance: Travel agents can provide valuable insights and assistance in planning your trip, ensuring you get the best value for your money. Their expertise can enhance your vacation experience without breaking the bank.

In conclusion, while humor is a powerful tool for communication, it's crucial to be mindful of the topics we find amusing. While the allure of an immediate vacation may be tempting, the long-term consequences of accumulating debt for leisure can outweigh the temporary enjoyment. By prioritizing strategic savings or utilizing travel agents offering installment plans, you can achieve your travel goals without compromising your financial well-being. Remember, the key is to create lasting memories without the lingering stress of financial obligations.

Let us do the work for you now and make your travel plans a stress-free experience!

Happy travels!

Caroliz Travels

Certified, Licensed,

and Insured Travel Advisor

WhatsApp/text/call: +1954-628-2901

Comentários